Introduction

Glossary

What are modules and how to search modules

What is a Widget?

Organisation in general

Terms by organization name

Wat is person in Newbase?

Difference between contact and person

Use of addresses

Telephone number format

What is a customer project

Pre- post calculation on a customer project

Difference between to be claimed and to be invoiced

Role

Hour type

Cost type

ETA - Estimated Time of Arrival

ETD - Estimated Time of Departure

Difference between a set and a composed product.

What are valuelists?

What is a template?

What is return value?

What is an order proposition?

What are dimensions?

What is a correspondence user?

What is dropshipment / dropshipping

General functions

Send login details

Log in to Newbase

Difference start screen - summary screen - edit screen - quick edit

Change / edit name / title of a tab

How to search in Newbase

Create and save your own search on a summary screen or in a list

Standard (pre-programmed) list views

Show totals of a list

How to adjust the order of columns in a list

Group data in a list and/or select which colums in a list you want to see

Listview editor - create your own list - add standard lists

Turn a listview into a board view

Add or remove colums within a widget

Duplicate / Copy documents and possibly renew data

Replace data in a selection of records

Navigate to related records

How does file storage work in Newbase? How are pdf files created?

Shortcuts

Webservice / API Newbase

Why don't I see the 'next step' button?

Copy widgets and privileges from role to role

Processes

CRM

Create organisation

Modify organisation address

Create contact

Modify organisation address (duplicate)

Create a new private contact or create a private contact from an existing person

Create message

Send invoice to department > create department as contact

Check if messages are send

How to create a contact report

Working with taska

How to create a note

Replacing an internal employee at an organization or contact in one go

Create an appointment

There is no email address in a message

Delete contact or set to inactive?

Unable to send a message / email

Import / sychronise emails

Sending emails / messages in a series / batch

Entry screen of a message

Relocation, address or reachability changes in future

Message content has different fontsizes

Export CRM data such as email addresses and addresses to Excel

Products

Create product group

Link a product to a product group

Can you link a product to multiple product groups?

Create a product

Where to enter of adjust the sales price of a product

Purchase price product: with or without (multiple) supplier(s)

Add stock location to a product > create stock product

Set unit / entity code of purchasing & sales for a product

Add product image

Link product attachment and send automatically

Working with stock finished products (SFP) - producing for stock with an assembly order

How to set the standard purchase price of a product?

Update standard purchase price of existing products

Standard purchase price at a composed product

Consequences of entering standard purchase price afterwords

Does the standard purchase price determine the margin?

Calculation stock value via standard purchase price

Product can only be purchased for stock

Can you change a product code?

Check and allow double (duplicate) product codes / part numbers

Blocked or phased out products

Stock value on x date

Create a composed product

Price agreements debtor (per product or per rebate group)

Create of modify commercial description of a product > multiple languages

How can you find product that not have been sold during the last 'X' period

Create a set of products

Sales

Create sales lead

Create sales opportunity

Create sales quotation

Set validity period on sales quotations

Create sales order

Credit sales order

Link a payment phasing to a sales order

Search for payment phasing lines still to be invoiced and create invoices

Modify / adjust existing payment phasing line

Create sales invoice

Booking sales invoices to Twinfield

Credit sales invoice

Delete a sales invoice

Create proforma invoice

UBL (XML) Sales invoice - e-factoring - OIN - HRN number

Link products to a document

How can I see the stock in a sales document?

Create a collective invoice from different sales orders or deliveries (collect invoice lines)

Why is a sales order not found using the query 'to be invoiced'

How does a discount / surcharge work in Newbase?

Re-book a sales invoice to Twinfield or set it to manually booked

Give a sales invoice another date - backdating

Set a sales invoice (partly) to paid manually

Whether or not to print a sales invoice line with number 0

There is no VAT on the order or invoice

Want to link a debtor to a document but cannot find the debtor?

Adjust quantities on a sales order if there is already a purchase order, receipt, delivery?

Whether or not to print a sales invoice line with quantity 0

List of sales invoices with purchase - sales - margin

How is the expiry date of a sales invoice determined?

Check stock within a sales order

Error when booking to Twinfield: ...performance type must be entered

Create RMA (Return Merchandise Authorization)

Reserve products for a sales quotation

Replace discount/surcharge in all lines in one go

How can you renew / update product data in existing financial sales documents?

Set a sales order to 'paid'

Overview and check payment phasings via listview sales orders

Standard query 'my open sales quotations'

Search for sales orders still to be invoiced

Export lines to excel

Why is the sales price not adjusted and what is the difference between updating and indexing product prices?

How does drop shipment / drop shipping work in Newbase?

Purchase

Book purchase invoice to Twinfield

How to create a creditor

Create purchase order via a RFQ (request for quotation)

Create separate purchase order (by for stock)

Create a purchase order via sales order (no stock booking)

Create purchase orders from a selection of sales orders (collect)

Linking a project to a purchase order after goods are received

Cancel a purchase order

Prepay a purchase invoice (pro forma purchase invoice)

Indicate goods that will no longer be received

Book a purchase invoice or a sales invoice from a previous year

Create RTV (Return to Vendor)

Purchasing for multiple projects and/or sales orders on one purchase order

How do you find purchase orders (lines) for which the receipt (line) has not yet been linked to a purchase invoice (line)?

Delivery date on a purchase order

How can you see on a purchase invoice line whether a receipt has been linked?

How can you see on a purchase order or receipt whether a purchase invoice is linked?

Logistics

Stock value list

General informatie goods delivery

Create 1 of more delivery notes

Partial delivery (of composed product)

Print a delivery note / pick list

Search for goods that are still to be deliverd

Deliver more goods than on sales order

Indicate that goods will no longer be delivered

Return delivery of products that have already been issued

Creata a receipt / adjust quantiy on receipt

Separate stock mutation / stock correction

How does stock work in Newbase? Why are products not added to the stock

Search for products / goods still te be received (purchase order to be received)

Purchasing for stock with an stock order proposal

Set a sales order to 'manually invoiced' (duplicate)

Set that goods cannot be deliverd if not paid / block delivery

When is a product allocated > what is allocation?

How can you see on a receipt which goods still need to be delivered?

How do you get products back into stock if you are not going to deliver them?

Move stock of 1 or more products to another stock location

Do you work multi-company and want to purchase from company B for a sales order from company A?

Search for products to be ordered

Projects

Work with hour types and cost types

The order of determining an hourly rate on a project

Change project status

Create a (private) debtor (and choose company)

Link a different debtor to a organization (debtor connection)

Get payments from Twinfield (debtors)

Manually set an invoice to booked or not booked in Newbase

Can you duplicate a purchase order to a purchase invoice?

Search for sales invoices to be reminded via the open sales invoices module

Set debtor or invoice to: do not remind / no reminders

Journal entries

Set debtor to direct debit

Sales invoice always to the same person / contact

Product prices have changed and would you like to update them on member lines?

Import and export functions

Settings

Create personal shortcuts

Modify widgets (add, move, remove, resize)

Create new user

Give permission to send message from or on behalf of another user

De-block user

Delete user or set to inactive?

Edit role options: rights - privileges - options - searches - required fields

Setting up 2 factor authentication

Setting up Microsoft Office 365 (Mail and Sharepoint)

How can an application manager authorize Microsoft 365 for a user

Before you start setting up reference numbers

Using code at settings reference numbers

What is the program translations?

Editing or creating translations

How do you create a template for a message or a start/end text of a document?

Merge codes in a template

Link attachement to template

General information ledgers

Create or change ledger numbers

Where can you find ledger numbers and what order of ledger numbers is used?

Where can you enter cost accounts?

Create a payment phasing (settings)

VAT codes Newbase - Twinfield

VAT Settings

Send URL / link / login details for time registration / TIME application

HTML usage in Newbase

How does currency work within Newbase

What to do at an annual change?

Change / adjust a print with parameters or add an extra print

Select another company (for multi-company use)

How to create a stock location

Message not send / marked as send

Work with a Print template (MS Word)

Customize start / home screen - add new/additional home screen at top left - add modules

Export user role privileges

Missing attachments for Peppol purchase invoices

Peppol matching of debtors and creditors

Unable to email message with attachment > File cannot be saved Microsoft 365

Setting up Peppol via Storecove for purchase and/or sales invoices & tips

Explanation of user checkboxes

Error message Peppol

Changing widgets from one role to another by the application administrator

Add overview / dashboard with numbers (to see work load)

Error: Cannot Parse XML error

Widgets summary

Errors

Error when booking to Twinfield: ... dimension 2 cannot be empty when dimension 3 is used

Error when booking to Twinfield: ...booking not balanced

Error when booking to Twinfield: ..... cannot be sub analyzed

Error when booking to Twinfield: ....invalid performance country (duplicate)

Error when booking to Twinfield: ...booking not balanced (duplicate)

Error when booking to Twinfield: ....invalid performance country

Error: type error can't use in on a non object....drive Api

Error: Cannot read property 'length' from ...drive api

- All Categories

- Settings

- VAT Settings

VAT Settings

Updated

by MJA

Updated

by MJA

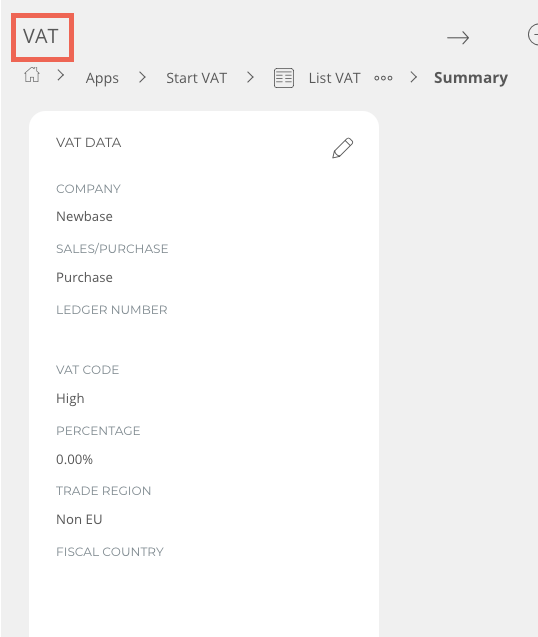

Within the VAT program VAT data can be entered for the purpose of calculating VAT and the accounting processing thereof. The VAT settings are transferred to financial documents based on the debtor data.

- Go to the module VAT

- To create a new record click on new, to edit a record select the record that you want to edit

Below an explanation of the fields:

Company: | If you work with multiple companies in Newbase, choose the relevant company here |

Sales / Purchase: | It is mandatory to fill in whether it concerns the VAT settings for sales or purchases |

Ledger No.: | Not in use |

VAT Code: | You choose the type with a predefined selection list. The choices are VAT high, low, 0, none or shifted. |

Percentage: | The applicable percentage for the VAT institution. To enter 21%, enter 21 (not 0.21). |

Trade region: | You choose the trade region from a predefined lookup list. The choice are own country, EU and Non EU. |

Fiscal country: | This field only needs to be filled in when different VAT is used in certain circumstances. Please contact Newbase for this. |