Table of Contents

- 1. When are journal entries created?

- 2. Automatically book journal entries to Twinfield?

- 3. Balance sheet (customer project) and profit & loss bookings

- 4. Which journal entries are used?

- 5. Journal entries upon receipt

- 6. Journal entries upon delivery

- 7. Time journal entries

- 8. Journal entries for purchase invoices

- 9. Journal entries for sales invoice

- 10. Journal entries for costs

- 11. Journal entries for inventory revaluation

- 12. Journal entries for stock changes

- 13. Journal entries when taking interim results on a customer project (% of completion).

- 14. Financially close journal entries for customer project

- 15. Journal entries for stock inter-company booking

- 16. Additional information

- 17. Check …. matching / connection

- 17.1 Stock connection

- 17.2 Sales invoices reconciliation

- 17.3 Purchase invoice reconciliation

- 17.4 Connection invoices still to be received

- 17.5 Costs and Proceeds of work in progress connection

- 17.6 Outstanding sales invoices

- 17.7 Outstanding purchase invoices

- 17.8 Differences

- 17.8.1 Locking

- 17.8.2 Suspense account

- 17.8.3 Change in Twinfield

- 18 Transition / start of opening balance

Journal entries

Updated

by MJA

Updated

by MJA

- 1. When are journal entries created?

- 2. Automatically book journal entries to Twinfield?

- 3. Balance sheet (customer project) and profit & loss bookings

- 4. Which journal entries are used?

- 5. Journal entries upon receipt

- 6. Journal entries upon delivery

- 7. Time journal entries

- 8. Journal entries for purchase invoices

- 9. Journal entries for sales invoice

- 10. Journal entries for costs

- 11. Journal entries for inventory revaluation

- 12. Journal entries for stock changes

- 13. Journal entries when taking interim results on a customer project (% of completion).

- 14. Financially close journal entries for customer project

- 15. Journal entries for stock inter-company booking

- 16. Additional information

- 17. Check …. matching / connection

- 17.1 Stock connection

- 17.2 Sales invoices reconciliation

- 17.3 Purchase invoice reconciliation

- 17.4 Connection invoices still to be received

- 17.5 Costs and Proceeds of work in progress connection

- 17.6 Outstanding sales invoices

- 17.7 Outstanding purchase invoices

- 17.8 Differences

- 17.8.1 Locking

- 17.8.2 Suspense account

- 17.8.3 Change in Twinfield

- 18 Transition / start of opening balance

This document describes working with journal entries in Newbase.

Whether you work with journal entries is determined (and configured) during the implementation of Newbase

1. When are journal entries created?

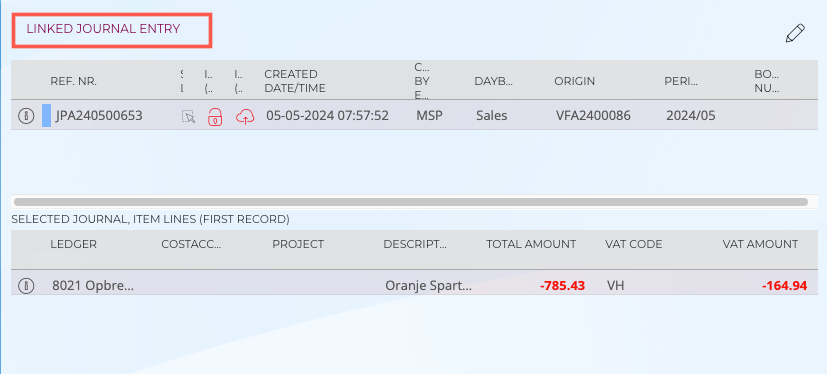

Journal entries are created after locking a financial document. You can find all created journal entries in the journal entries module, but also in the financial document itself via the 'linked journal entry' widget.

2. Automatically book journal entries to Twinfield?

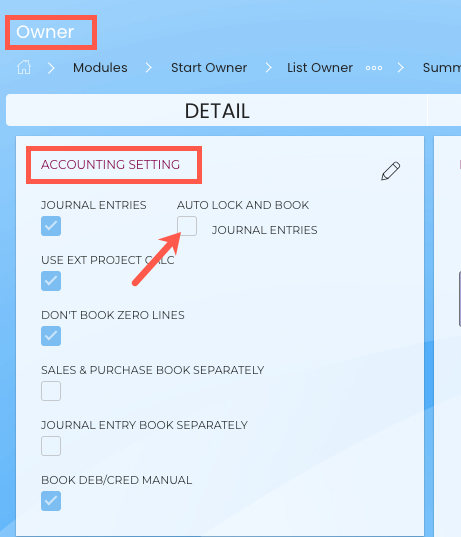

You can choose whether or not to automatically lock and book journal entries directly to Twinfield. Our advice is not to automatically book journal entries to Twinfield in the beginning. Therefore, temporarily set the 'auto lock' checkbox to 'off' during the implementation. This way they can first be checked before they are transferred to Twinfield. This check mark is in the Accounting Settings widget of the Owner module.

After the Newbase application has gone live, the 'auto lock' option can be enabled. From then on, all journal entries will end up directly in the Twinfield.

It is possible to lock an invoice without immediately creating a journal entry. If this check box is checked, a journal entry will not be immediately created when an invoice is locked. The 'booklet' remains open. This allows a sales invoice to be easily unlocked and locked again without new journal entries being created each time. This check mark is in the Accounting Settings widget of the Owner module.

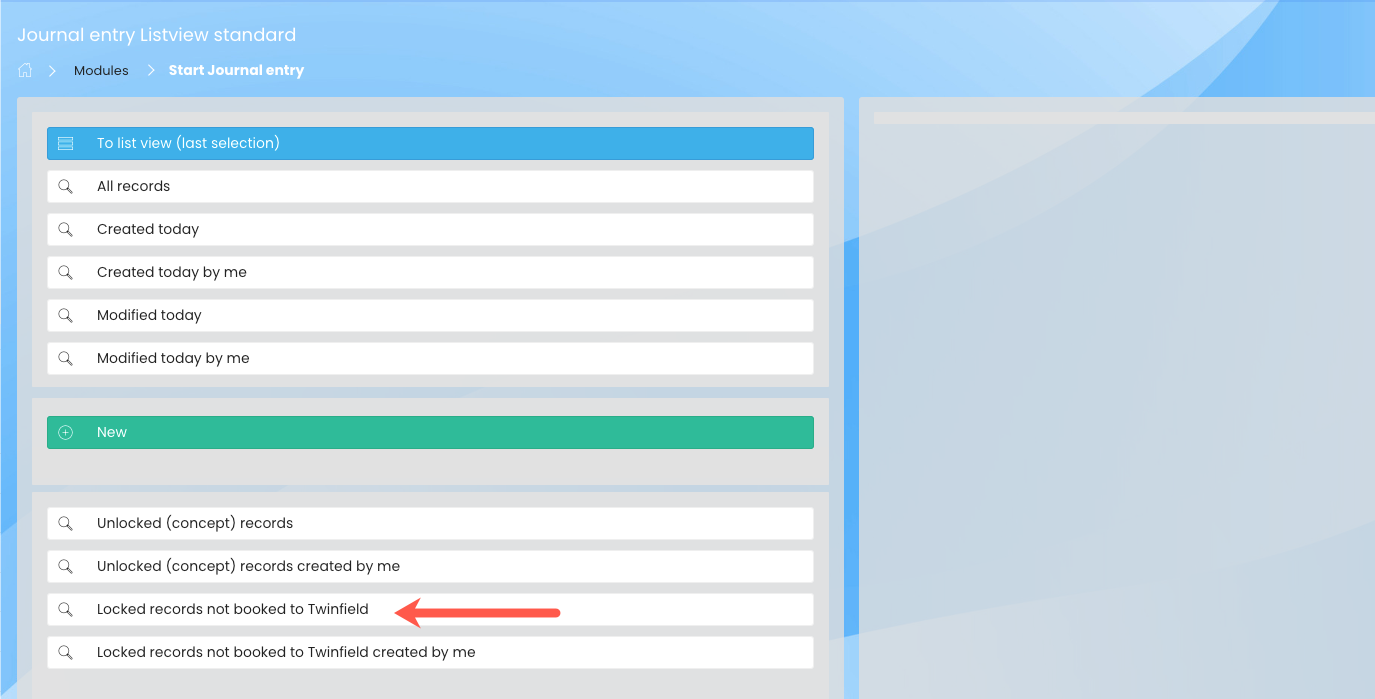

2.1 Search for journal entries not booked

Using the standard search 'show all unlocked records' you can easily find journal entries that have not yet been booked. This search is on the home screen of the journal entries module.

3. Balance sheet (customer project) and profit & loss bookings

All journal entry entries go straight into Profit & Loss, except for customer projects. Customer projects are often projects that last longer than one period. For this reason, an exception has only been made for customer projects and all costs and revenues that are booked on a customer project are first booked to the balance sheet. When a customer project is closed, the revenues and costs are removed from the balance sheet and included in the result.

If you decide to immediately include customer projects in the result, you can set this in the journal entry. Please contact Newbase for this.

Journal entry settings are then defined that you may never use, such as receipt on an internal project. Since this is theoretically possible within Newbase, you must always set these journal entries.

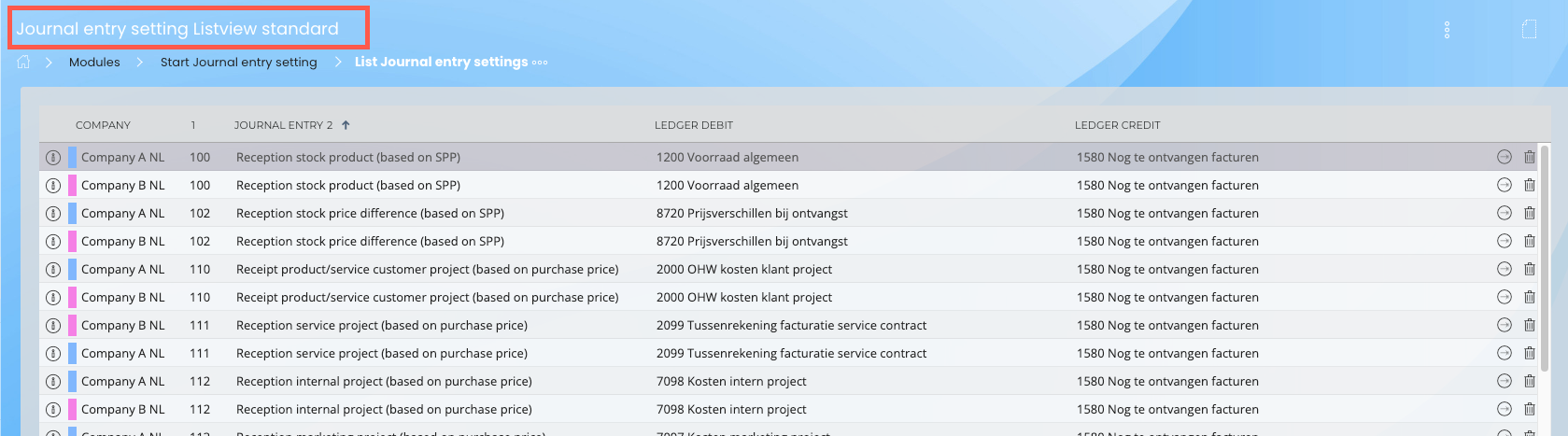

4. Which journal entries are used?

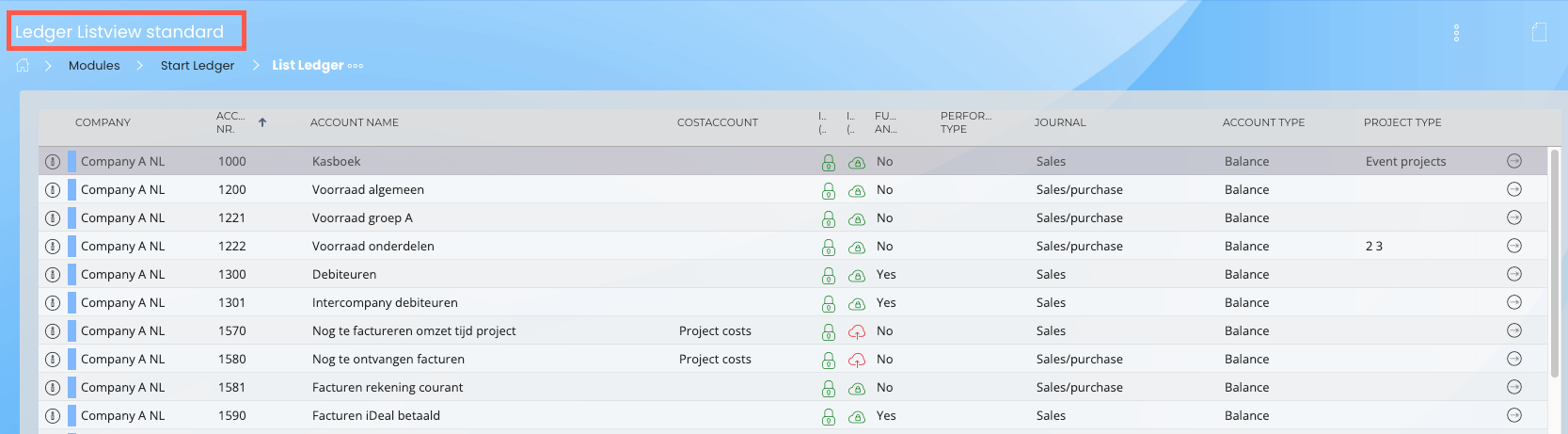

Newbase is set up with a standard journal entry schedule. This schedule can of course be adjusted.

This schedule can be found in the Journal Entry Settings module.

The ledger account numbers used here can be found in the ledger module.

To check whether non-existent general ledger account numbers are not used in the journal entry settings, a standard search action is available with which you can search for this.

The following chapters describe the standard journal entry schedules per module.

5. Journal entries upon receipt

A receipt is always based on a purchase order and has the following principles:

- You can post to multiple inventory accounts. You can define this within product group and product

- A receipt on a customer project is first booked to the balance sheet

- A price difference for a stock product based on VVP (Fixed Transfer Price) is immediately booked as an additional journal entry upon receipt

- All other receipts go straight into the result

- Since it is possible within Newbase to post a receipt within different modules, all possible journal entries must also be defined. For example, the receipt of a purchase on a marketing project. This entry can be created within Newbase, so a journal entry must be made against it

- With a standard purchase resulting from a sale, you can post to multiple cost price accounts. You can define this within product group and product. In other words, cost of sales is booked immediately upon receipt when a stock product is purchased for a sales order. The booking will not be made upon delivery

- Regarding journal entry number 130: since the debit side is determined by the content of the purchase order account number, you can leave it empty

- Regarding journal entry number 140, suppose there is no account number in the purchase order line, then you can transfer, but Newbase then uses this safety net account. Of course you must complete the product groups with the general ledger numbers for the three trading regions, so that in theory you cannot book on 9999

- With project modules, you can only lock open projects.

5.1 Standard chart of accounts receipt journal entries

Newbase is set up with the following scheme as standard. The general ledger account numbers used can be adjusted to the customer's schedule.

100 receipts stock product

1200 Stock (balance) |

TO 1580 invoices to receive (balance) |

If a stock account number is known within the product group / product, it will be copied within the line and will then be used as a standard booking. If no stock account is defined within product group / product, then the stock account will be empty within the receipt line, and the default account will be used which is defined within the journal entry (in this case 1200).

102 receipt stock price difference

8720 Price differences at receipts (P&L) |

TO 1580 invoices to receive (balance) |

The reason for this (extra) journal entry is that you want to have your total amount of "invoices yet to be received" booked upon receipt. So that is why, when Newbase receives a stock product that is booked as VVP for 10 EURO, the stock is booked for 10 EURO with a quantity of 1, and if you have purchased for 12 EURO the system immediately books "price differences upon receipt", as well as for that difference amount of 2 EUR constitutes the “invoices yet to be received”.

110 receipt customer project

2000 work in progress cost customer project (balance) |

TO 1580 invoices to receive (balance) |

111 receipt service project

7099 Cost service contract (P&L) |

TO 1580 invoices to receive (balance) |

112 receipt internal project

7098 Cost internal project |

TO 1580 invoices to receive (balance) |

113 receipt marketing project

7097 Cost marketing project (P&L) |

TO 1580 invoices to receive (balance) |

114 receipt event project

7093 Cost event (P&L) |

TO 1580 invoices to receive (balance) |

117 receipt complaint project

7094 Cost complaint (P&L) |

TO 1580 invoices to receive (balance) |

120 receipt sales order

7020 Cost sales (P&L) |

TO 1580 invoices to receive (balance) |

If an account number of the cost price is known within the product group / product, it will be copied within the line and will then be used as a standard booking. If no stock account is defined within product group / product, then the stock account will be empty within the receipt line, and the default account will be used which is defined within the journal entry (in this case 1200)

121 receipt service request / order / report

7096 Cost service request/order (P&L) |

TO 1580 invoices to receive (balance) |

122 receipt assembly order

7095 Cost assembly order (P&L) |

TO 1580 Invoices to receive (balance) |

130 receipt account nr. line

???? contents of the purchase order invoice (P&V) |

TO 1580 Invoices to receive (balance) |

As soon as the above conditions do not apply, the system will use this account number if a purchasing account number has been entered in the purchase order line.

140 receipt account nr. general

9999 Safety account (P&V) |

TO 1580 Invoices to receive (balance) |

None of the above conditions apply, so the system uses journal entry number 140 as a last resort.

5.2 Reception with an average purchase value?

You can also work with an 'average purchase price' instead of a 'fixed transfer price'. A fixed transfer price is simple. You set a fixed transfer price once per product. Receipts and deliveries are booked based on this price. At the end of the year you count the stock and you have the option to set a different VVP for products, which will immediately record a revaluation.

As soon as you work with average purchasing, an extra journal entry is created every time you post a receipt, namely the revaluation. The following journal entries are created:

Upon the very first receipt of a purchase order (10 pieces of product 1234, 1 euro each):

1200 Stock general 10,00 |

TO 1580 Invoices to receive 10,00 |

On the second receipt of a purchase order (10 pieces of product 1234, 2 euros per piece):

1200 Stock general 15,00 |

TO 1580 Invoices to receive 15,00 |

8720 Price differences at receipt 5,00 |

TO 1580 Invoices to receive 5,00 |

As well as a stock revaluation: 1200 General stock 5.00 ON 8700 General stock revaluation 5.00 |

Based on the following calculation:

( (current stock * avg. purchase product) + (receipt quantity * receipt line price) ) / (current stock + received stock)

above based on example:

( ( 10 * 1.00 ) + ( 10 * 2.00 ) ) / ( 10 + 10 )

The average purchase of the product is set at 1.50.

5.3 reception with avg. purchase value, better purchase price, loss of receipt

Suppose you buy the same product again in a certain period. This means that better purchasing results in a lower average purchasing value and is immediately booked as a loss. This results in a higher margin when selling, and therefore a higher profit.

5.4 Unlock reception again, what does the system do?

Suppose you have locked a reception, and you unlock it. Then all necessary entries are processed, namely journal entries:

The reverse entry via the receipts module:

8700 Stock revaluation general |

TO 1200 Voorraad general |

6. Journal entries upon delivery

A delivery is always based on a sales order, service request, service order or assembly order. Below are a number of principles:

- A journal entry is only created if it concerns a stock product

- You can post to multiple inventory accounts. You can define this within product group and product

- A delivery on a customer project is first booked to the balance sheet

- All other deliveries are immediately included in the result

- Since it is possible within Newbase to book a delivery within different modules, all possible journal entries must also be defined, for example the delivery on a marketing project. This entry can be created within Newbase, so a journal entry must be made against it

- For a standard delivery resulting from a sales order, you can post to multiple cost price accounts. You can define this within product group and product

- A delivery of a product that has previously been purchased specifically for the sales order, service request, service order or assembly order (i.e. a purchase order has been created from this document) is journalized upon receipt, and therefore no longer journalized upon delivery

- For projects, you can only lock modules on open projects

- If a stock account number is known within the product group / product, it will be copied within the line and will then be used as a standard booking. If no stock account is defined within product group / product, then the stock account will be empty within the receipt line, and the default account will be used which is defined within the journal entry (in this case 1200)

6.1 Standard chart of accounts for delivery journal entries:

Newbase is set up with the following scheme as standard. The general ledger account numbers used can be adjusted to the customer's schedule.

200 delivery stock with customer project

2000 Work in progress costs customer project (balance) |

TO 1200 Stock (balance) |

201 delivery stock with service project

7099 Cost service contract (P&L) |

TO 1200 Stock (balance) |

202 delivery stock with internal project

7098 Cost internal contract (P&L) |

TO 1200 Stock (balance) |

203 delivery stock with marketing project

7097 Cost marketing contract (P&L) |

TO 1200 Stock (balance) |

204 delivery stock with event project

7093 Cost event contract (P&L) |

TO 1200 Stock (balance) |

207 delivery stock with complaint project

7094 Cost complaint contract (P&L) |

TO 1200 Stock (balance) |

220 delivery stock with sales order

7099 Cost sales order (P&L) |

TO 1200 Stock (balance) |

For a standard delivery resulting from a sales order, you can post to multiple cost price accounts. You can define this within product group and product. As soon as no cost price sales account number is defined within the sales order line, the standard journal entry account number will apply (in this example 7020).

221 delivery stock with service request/order/report

7096 Cost service request/order (P&L) |

TO 1200 Stock (balance) |

230 delivery stock with assembly order

7095 Cost assembly order (P&L) |

TO 1200 Stock (balance) |

7. Time journal entries

- A time line on a customer project is first booked to the balance sheet

- Possible purchases of kilometers and travel time are immediately totaled (purchases) and journalized

- With project modules, you can only lock open projects

- Time based on a service request/order/report without a service contract is booked under journal entry 380

7.1 Standard chart of accounts journal entries time

Newbase is set up with the following scheme as standard. The general ledger account numbers used can be adjusted to the customer's schedule.

300 time on open customer projects

2000 Cost customer projects (P&L) |

TO 6990 Charged time for customer project (P&L) |

310 time on open service projects

7099 Cost service project (P&L) |

TO 6993 Charged time for service project (P&L) |

320 time on open internal projects

7098 Cost internal projects (P&L) |

TO 6992 Charged time for internal project (P&L) |

330 time on open marketing projects

7097 Cost marketing projects (P&L) |

TO 6991 Charged time for marketing project (P&L) |

340 time on open event projects

7093 Cost event projects (P&L) |

TO 6995 Charged time for event project (P&L) |

361 time on open complaint projects

7093 Cost complaint (P&L) |

TO 6995 Charged time for complaing project (P&L) |

370 time without projects

7004 Cost without projects (P&L) |

TO 6998 Charged time without project (P&L) |

380 time based on a service request/order

7096 Cost service request/ projects (P&L) |

TO 6994 Charged time for event project (P&L) |

The charged time booking concerns a profit and loss account. This is then reversed per period through the payroll journal entry, with or without a suspense account (where applicable).

8. Journal entries for purchase invoices

There are two types of purchase invoices:

1. purchase invoices for goods ordered and received from Newbase

2. purchase invoices for products or services that have not been ordered and received via Newbase. Consider the rent on internet costs. (cost invoices)

When a purchase invoice of type 1 is booked and matched against a receipt line, since the journal entry line in the receipt has been booked to 1580 'Invoices still to be received' (balance sheet), this will be reversed when the purchase invoice is matched to 1580 'Still to be received'. invoices received' (balance sheet). Because a receipt line has been linked, you cannot change the general ledger number in the line.

When a purchase invoice of type 2, which is not matched against a receipt, is booked, you must enter the correct general ledger number in the lines yourself.

8.1 Purchase invoices for customer projects

When you have ordered goods for a project, these goods are charged to the project via receipt.

The purchase invoice is treated as explained in type 1.

8.2 Additional costs on a purchase invoice for a customer project?

However, it may happen that there are additional costs on the purchase invoice afterwards that have not been ordered and received but must still be charged to the project. You do this by creating an extra free line on the purchase invoice and adding the project number in this line. This line must always contain the general ledger number 2000 WIP costs for customer project. If you do not use this ledger number, you will have problems with the connection. Since the costs are booked in Newbase on the project, but not on 2000 WIP costs for customer project.

To prevent this, Newbase can now be set up in such a way that the selection of the general ledger number on purchase invoice lines on which a project is located is done automatically. You do this by indicating in general ledger numbers that 2000 WIP costs for customer projects may only be used on a customer project. You can also make this setting for the general ledger account numbers that are special for a service contract, internal project, marketing project or event.

Below is the procedure to set the above:

- Go to the Ledger accounts module and the 'ledger information' widget

- Find the relevant ledger number you want to set, for example 2000 WIP costs for customer project

- Click on customer project in the 'type of project' field, which will then be highlighted in blue

This applies equally to service project, internal project, marketing project and event project:

- customer project 2000 WIP in progress costs customer project

- service contract 7099 Service project costs

- internal project 7098 Internal project costs

- marketing project 7097 Marketing project costs

- event 7093 Event cost

What to do with additional costs received on a purchase invoice?

You may incur additional costs. These were not ordered via Newbase but must be charged to the project. What you then do is create a new line on the purchase invoice, enter the costs and the project number here. Newbase then obliges you to use general ledger number 2000 WIP costs for customer project, but in the description field you can indicate what type of costs it concerns.

Suppose you cannot choose a general ledger number, then you have probably defined the same type of project twice on this general ledger number.

8.3 To distribute purchase invoice

Suppose you receive a purchase invoice for rent, then you would like to distribute it within Twinfield. It is not possible to distribute costs within the Newbase purchase invoices module. This means that you must work with a suspense account. The rent can then be booked as standard on a suspense account “XXXX rent to be distributed 3 months”. In this way it is immediately visible within Twinfield which items still need to be distributed within Twinfield. Within Twinfield, the item “XXXX rent to be distributed 3 months” can then be divided over three periods on account number “XXXX rent”.

8.4 Standard chart of accounts for purchasing journal entries:

Newbase is set up with the following scheme as standard. The general ledger account numbers used can be adjusted to the customer's schedule.

400 purchase invoice based on receipt

1580 Invoices still to be received, this cannot be changed because it is linked to a receipt line (balance) |

TO XXXX you can leave this blank, it will default to 'VAT to be claimed' and 1600 creditors |

A cost (purchase) invoice is always booked to the account number of the purchase invoice itself, for example:

9040 Exchange rate differences, this can be changed per purchase invoice line because it is not linked to a receipt line (balance sheet) |

TO XXXX you can leave this blank, it will default to 'VAT to be claimed' and 1600 creditors |

9. Journal entries for sales invoice

You only need to fill in the credit line, as the debit line is automatically filled by Newbase with 'VAT to be paid' and 1200 debtors.

Comments:

- A sales invoice on a customer project is first posted to the balance sheet.

- You can use multiple revenue sales accounts. These journal entries are set up as follows:

- If a sales ledger number has been entered for a debtor, this will be used (in journal entry 510)

- If a ledger number has been entered for a product, it is copied to the sales invoice line and used

- If a ledger number has been entered for a product group, it will be copied to the sales invoice line and used

- If no ledger number is known, the account number from the default setting of the journal entry is used

9.1 Standard chart of accounts sales invoice journal entries:

Newbase is set up with the following scheme as standard. The general ledger account numbers used can be adjusted to the customer's schedule.

500 sales invoice based on a customer project

XXXX can be left blank, it will default to 'VAT payable' and 1300 accounts receivable |

TO 8099 Service contract revenue (P&L) |

501 sales invoice based on a service project

XXXX can be left blank, it will default to 'VAT payable' and 1300 accounts receivable |

TO 8099 Service contract revenue (P&L) |

502 sales invoice based on a internal project

XXXX can be left blank, it will default to 'VAT payable' and 1300 accounts receivable |

TO 8099 internal contract revenue (P&L) |

503 sales invoice based on a marketing project

XXXX can be left blank, it will default to 'VAT payable' and 1300 accounts receivable |

TO 8097 marketing contract revenue (P&L) |

504 sales invoice based on a event project

XXXX can be left blank, it will default to 'VAT payable' and 1300 accounts receivable |

TO 8093 event contract revenue (P&L) |

507 sales invoice based on a complaint project

XXXX can be left blank, it will default to 'VAT payable' and 1300 accounts receivable |

TO 8094 Complaint contract revenue (P&L) |

510 sales invoice based on a sales order

XXXX can be left blank, it will default to 'VAT payable' and 1300 accounts receivable |

TO revenue account number debtor or product group or product or the default setting of the journal entry |

511 sales invoice based on a service request / project

XXXX can be left blank, it will default to 'VAT payable' and 1300 accounts receivable |

TO 8096 service request / project revenue (P&L) |

512 sales invoice based on a assembly project

XXXX can be left blank, it will default to 'VAT payable' and 1300 accounts receivable |

TO 8095 Assembly contract revenue (P&L) |

It is also possible to create cost price bookings using the sales invoice. This means that when a sales invoice is locked, two entries are made.

-a revenue entry (see journal entry numbers 500 to 512)

-a cost price entry (see journal entries below)

This means that the system immediately realizes the cost price entry for the journal entries below.

551 cost price entry for sales invoice based on a service contract

554 cost price entry for sales invoice based on a sales order

555 cost price entry for sales invoice based on a service request/order/report

This booking is only made on the sales invoice line with the following condition:

1. everything as has been previously ordered.

2. only the delivery of a stock product is upon delivery and has not previously been ordered

This has the consequence that upon receipt and delivery of a document based on a service contract, sales order or a service request/order/report, the receipt/delivery can be posted to a suspense account (e.g. WIP purchases sales), and this is reversed through the cost price booking.

The example below is based on a sales order.

Step 1. Issuance

220 delivery stock with sales order

Purchase 2220 WIP for sales order

TO 1200 Stock

Step 2 Sales invoice

XXXX can be left blank, it will default to 'VAT payable' and 1300 accounts receivable

ON proceeds from debtor account number or product group or product or the default setting of the journal entry.

And the cost price booking via the sales invoice

520 cost of sales invoice based on sales order

7020 Sales cost (P&V)

TO 2220 WIP purchase for sales order

*As soon as a cost price entry via the sales invoice is used, the relevant receipt/delivery will use the entry from the journal entry, and not the possible depth to product group/product since the suspense account (in this example 2220 WIP purchases for sales order) uses and only when booking the cost price will the possible depth per product group/product be used.

A sales invoice that does not meet the above conditions uses the general ledger number of the sales invoice line itself, so you do not need to set up a journal entry for this. If no general ledger number has been set in the sales invoice line, the system uses the standard sales general ledger number which you can set in settings / company / accounting.

9.2 To distribute sales invoice

Suppose you want to book a sales invoice regarding service contracts turnover, then you would like to distribute it within Twinfield. It is not possible to distribute turnover within the Newbase sales invoices module. This means that you must work with a suspense account. The service contract turnover can then be booked as standard on a suspense account:

XXXX service to be distributed 3 months or

XXXX service to be distributed 6 months or

XXXX service to be distributed 12 months or

In this way it is immediately visible within Twinfield which items still need to be distributed within Twinfield. Within Twinfield, the item “XXXX service to be distributed for X months” can then be divided over X periods on account number “XXXX service turnover”.

10. Journal entries for costs

- A cost line on a customer project is first posted to the balance sheet

- Costs is a 'strange' module, as all costs are posted via the purchase invoice program

- You can use the costs module for, for example, internal charging (printer costs, etc.)

10.1 Standard chart of accounts cost journal entries:

Newbase is set up with the following scheme as standard. The general ledger account numbers used can be adjusted to the customer's schedule.

600 cost based on an open customer project

2000 Work in progress cost customer project (balance) |

TO xxxx ledger number of the cost line (P&L) |

610 cost based on an open service project

7099 Cost service project (P&L) |

TO xxxx ledger number of the cost line (P&L) |

620 cost based on an open internal project

7098 Cost internal project (P&L) |

TO xxxx ledger number of the cost line (P&L) |

630 cost based on an open marketing project

7097 Cost marketing project (P&L) |

TO xxxx ledger number of the cost line (P&L) |

640 cost based on an open event project

7097 Cost event project (P&L) |

TO xxxx ledger number of the cost line (P&L) |

661 cost based on an open complaint project

7093 Cost complaint project (P&L) |

TO xxxx ledger number of the cost line (P&L) |

670 cost without project

7004 Cost without project (P&L) |

TO xxxx ledger number of the cost line (P&L) |

11. Journal entries for inventory revaluation

As soon as you change the Fixed Transfer Price (VVP) within the product program, Newbase creates a journal entry (technical stock * (old price minus new price)).

11.1 Standard chart of accounts for stock revaluation journal entries:

Newbase is set up with the following scheme as standard. The general ledger account numbers used can be adjusted to the customer's schedule.

700 product revaluation

1200 Stock (balance) |

TO 8700 Revaluation of stock (W&V) |

If an account number of the stock revaluation is known within the product group / product, it is used as a standard booking. If a stock account number is known within the product group / product, it is used as a standard booking. If no stock account or stock revaluation account is defined within product group / product, then the default account defined within the journal entry will be used (in this case 1200 & 8700).

The VVP can be changed in two ways:

1. based on manual change per product

2. based on average purchase upon receipt

This concerns an “owner” setting.

12. Journal entries for stock changes

As soon as you change the stock within the Stock module, Newbase creates a journal entry (quantity * VVP or average purchase).

12.1 Standard chart of accounts journal entries Inventory change:

Newbase is set up with the following scheme as standard. The general ledger account numbers used can be adjusted to the customer's schedule.

800 stock change

1200 Stock (balance) |

TO 8710 Stock differences (P&L) |

If an account number of the stock transaction is known within the product group / product, it is used as a standard booking. If a stock account number is known within the product group / product, it is used as a standard booking. If no stock account or stock transaction account is defined within product group / product, the standard account will be used which is defined within the journal entry (in this case 1200 & 8710).

13. Journal entries when taking interim results on a customer project (% of completion).

The entries below are used as soon as '% of completion' is used within a financially open customer project. In this way an interim result is taken. The resulting booking will be immediately reversed in the next period. So you take a result in period x, which is reversed in period x+1. In period x+1 you post another '% of completion' record, which is reversed in period x+1+1. The two journal entries below are created in one go.

13.1 Standard chart of accounts journal entries % of completion:

Newbase is set up with the following scheme as standard. The general ledger account numbers used can be adjusted to the customer's schedule.

902 customer project perc. or completion costs

7300 Transit. customer project costs (P&L) |

TO 2300 Transit. customer project costs (balance) |

903 customer project perc. or completion revenue

3300 Transit. customer project costs (balance) |

TO 8300 Transit. customer project costs (P&L) |

14. Financially close journal entries for customer project

The bookings below are used as soon as a customer project receives a different financial status (tip: you can link a separate privilege 'change financial status' to this financial status field). The balance sheet is written off, and the Profit & Loss is taken.

The two journal entries below are created in one go.

14.1 Standard chart of accounts journal entries for closing customer project:

Newbase is set up with the following scheme as standard. The general ledger account numbers used can be adjusted to the customer's schedule.

900 customer project closing cost

7000 Costs of closed customer project (P&L) |

TO 2000 WIP costs customer project (balance) |

901 customer project closing revenue

3000 Work in progress customer project (balance) |

TO 8000 Revenue closed customer project (P&L) |

15. Journal entries for stock inter-company booking

Journal entry number 950 must be performed additionally if the company color of the stock is different from the header of the document upon receipt within journal entry number 100. Then you must post the VVP credit.

Journal entry number 951 must be performed additionally if the company color of the stock is different from the header of the document upon receipt within journal entry number 200, 201, 202, 203, 220, 221 and 230. Then you must enter the VVP debit .

You can only have 1 company in RC from which stock is written off. Example:

-Company B sells stock of a product from company A

-Company A has purchased the stock

upon receipt within company B, the following booking will take place:

-Company A has the inventory

-Company B purchases stock that is of a product from company A.

1200 Stock (balance sheet)

TO 1580 Invoices still to be received (balance sheet)

However, the stock belongs to company A, so an inter-company booking within company B

XXXX RC company A (balance sheet)

TO 1200 Inventory (balance sheet)

Since the company needs to have the stock booked, a booking will also be made there immediately:

1200 Stock (balance sheet)

TO XXXX RC of a company (balance sheet)

When delivering goods from company B:

7020 Sales cost (P&V)

TO 1200 Stock (balance sheet)

However, the stock does not belong to company B, so an intercompany booking within company B

1200 Stock (balance sheet)

TO XXXX RC company A (balance sheet)

Since company A needs to have the stock written off, a booking will also be made there:

XXXX RC300 of a company (balance sheet)

TO 1200 Stock (balance sheet)

So journal entry number 950 current account stock receipt must be set:

1581 Current account invoices

TO 1200 Stock general

So journal entry number 951 current account stock delivery must be set:

1200 Stock general

TO 1941 Current stock account

If you operate multiple companies, only one company can be the stock holding company. This means that all non-stockkeeping companies post to a general account XXXX RC.

If you work with, for example, 5 (so only if more than 2) companies that all have their own stock, then an RC is generally booked. Then you must run the inter-company export every period for the receipt line as well as the delivery line module. Based on this export, in combination with company code, the amount that must be reversed on the RC can then actually be determined. For example, company C has an amount RC of 10,000. Using the inter-company export from Newbase you can see that 4,000 must be settled with company A and 6,000 with company B.

16. Additional information

16.1 Changing general ledger numbers

16.2 Document without amount or Euro 00.00

When you work with journal entries, it is possible not to transfer lines of financial documents that contain no amount or the amount 0 (zero) to Twinfield. To do this, you must enable the option 'Do not book 0 lines' with the owner on the detail tab.

16.3 Delete set of journal entries within one document

If you work with journal entries, you have the option to delete a set of journal entries in one go within one invoice.

This is only possible if the sales invoice meets the following conditions:

- automatic posting of journal entries must be turned off

- it concerns a sales invoice

- The sales invoice is in edit mode

- the user has 'all privileges' or privilege 'delete set of records'/'delete foundset' within the journal entries program

- there is at least one line on the sales invoice that is linked to a service contract line

If the above conditions are met, a red cross will appear within the record info tab / journal entries sub-tab, allowing you to delete all journal entries at once.

Only unapproved journal entries from the relevant invoice will be deleted.

If a difference will arise, a message will be given with tips to possibly prevent the difference.

The action is logged in the action_log table. This can be seen in the 'action data' tab, which can be added as a sub-tab under the record info tab of the sales invoice.

17. Check …. matching / connection

To find a connection between the journal entries in Newbase and the modules from which these journal entries are generated, you can make a comparison yourself.

Please note: all records must be locked. The journal entries in Newbase are of course always the same as the journal entries in Twinfield. Newbase also receives a voucher number for each journal entry that is transferred.

Point of attention: If you work with journal entries and have set up that the sales & purchase book can be posted separately, you must actually post the locked sales & purchase invoices to Twinfield when collecting the figures. So everything must be both locked and booked.

17.1 Stock connection

Within the logistics module > stock > list view “stock value > show all. You see the technical stock value.

Within the administration module > journal entry lines > list view “standard view” search for general ledger number “stock”.

17.2 Sales invoices reconciliation

Within sales invoices module > list view “standard view”, show all. See total excl. VAT in company currency.

Within module administration > journal entry lines, list view “standard view” search by module name “sales invoice”. See total company currency.

17.3 Purchase invoice reconciliation

Within module administration > purchase invoices, list view “standard view”, show all. See total excl. VAT in company currency.

Within the administration module > journal entry lines > list view “standard view” search for module name “purchase invoice”. See total company currency.

Point of attention: One of the reasons that no connection can be found is the use of incorrect general ledger numbers on purchase invoice lines to which a project is linked.

17.4 Connection invoices still to be received

Within the logistics module > receipt lines > search action “to be processed on purchase invoice”. See amount to process

Within the administration module > journal entry lines, list view “standard view” search by general ledger number “invoices yet to be received”.

Point of attention: The general ledger number “1580 Invoices still to be received” is used upon receipt and subsequently reversed (as soon as a receipt line is linked as a purchase invoice line). This means that this account number may not be used as a separate purchase invoice line. If a difference arises on “ 1580 Invoices yet to be received”, then this is easy to check within purchasing invoice lines, search for the relevant account number, in this example “1580 Invoices yet to be received”, and check whether these are linked to a goods receipt. If errors have been made then you can reverse this in Newbase, program journal entry, and create a journal there.

17.5 Costs and Proceeds of work in progress connection

Within customer projects, look for financially open projects. Then detail view of work in progress, then export to Excel, then the system exports the contents of the “work in progress” tab. There you then have the columns “verk. fact. sales” and “total b. cost"

Here you have the totals:

1. current turnover

2. costs incurred

Then go to journal entry lines.

Search:

1. 2000 WIP costs for customer project, this total amount must be equal to the total costs.

2. 3000 WIP revenue from customer project, this total amount must be equal to the revenue.

17.6 Outstanding sales invoices

Within Newbase module administration > debtors, list view “30-60-90 incl. search”. You can compare this list with the debtor list in Twinfield.

17.7 Outstanding purchase invoices

Within Newbase purchasing module > accounts payable, list view “30-60-90 incl. search”. You can compare this list with the creditor list in Twinfield.

17.8 Differences

Newbase creates journal entries from the various modules.

An example of the process with a sales invoice:

Step 1. A sales invoice is created in Newbase. This will be locked.

Step 2. A journal entry is created. This is locked (automatically or not, depending on the owner setting)

Step 3. A concept booking is created in Twinfield.

Step 4. Concept booking is definitively booked in Twinfield. This cannot be changed anymore.

If there is a difference in your checklists, this may be due to the following reasons:

17.8.1 Locking

Not everything is locked in Newbase, but a comparison has been made. Then lock everything again and compare again.

17.8.2 Suspense account

For example, a booking has been made to a suspense account:

1. an entry has been made to account number 1580 Invoices still to be received, while no receipt line has been matched to this

2. WIP costs for customer project have been posted to account number 2000, while no project is linked to it

3. WIP revenue from customer project has been posted to account number 3000, while no project is linked to it

17.8.3 Change in Twinfield

A change has been made in Twinfield, while in fact it should have been booked via Newbase

In Twinfield, for example, a correction can be made to 2000 WIP costs for customer project

To reconnect, create a general entry in Newbase journal entries and reverse the balances.

18 Transition / start of opening balance

At moment X the company decides to switch to Newbase. Here we are dealing with the various balances on the various general ledger accounts that will be posted when starting Newbase. The starting position must be determined. There are various options for this. Below we explain how this can be dealt with.

18.1 Customer Projects

All current projects must be entered. The bookings to Twinfield are made via the underlying revenue and costs modules. A customer project itself does not generate financial bookings to Twinfield. Suppose there are 10 financially open customer projects, where a work in progress position needs to be booked based on these projects, this can be done as follows:

-all time lines must be entered. These can be locked, and work in progress costs are posted.

-if there are many time lines, you can book a total amount for each project via the cost program. The advantage is that you only have to enter 10 bookings for these 10 projects, instead of, for example, 1,000 time lines. The disadvantage of this is that you have no control over how much time has been written for these overflowing projects (after all, there are no time lines).

- enter all current purchase orders regarding these projects

- enter all receipts that apply to these projects

- enter all purchase invoices that apply to these projects

- enter all assembly orders that apply to these projects

- enter all deliveries that apply to these projects

- enter all sales invoices that apply to these projects

This way you automatically start with the correct work in progress item on your balance sheet.

It is necessary to carry out the above actions, because when closing a project, the totals per project WIP costs & WIP revenues are reversed on your balance sheet and transferred to your result.

18.2 Accounts receivable / sales invoices position

The old administration contains 100 sales invoices (outstanding invoices, as well as paid invoices from financially outstanding customer projects). The following question applies here. Do you work with work in progress? If so, you must enter all sales invoices (paid or unpaid) for projects in progress (financially outstanding). You can perform the following options:

- You work with “accrued debtors. Enter these sales invoices within Newbase, with the line description “conversion” and the total amount. Check each sales invoice with “status transferred”, as well as “fin. monitoring manually”, and determine within the payment tab what amount has already been paid.

- Status booked checked means that this invoice is no longer transferred to Twinfield, but is considered to have been transferred (after all, this sales invoice is included as a total amount via the opening balance "accruals and debits").

- Financial monitoring manually means that this sales invoice is left outside Newbase's control regarding whether or not it has been paid, as this invoice is not listed as a document as an invoice, but as part of the item "accrued debtors".

- Payment tab, indicate whether an invoice has been paid (in part) by means of an order line.

- You do not work with the item “accrued debtors”. Therefore, enter these sales invoices within Newbase (enable manual numbering) and post them. Of course, the periods to which the sales invoices relate must be open. The VAT is also recorded. Book this VAT against periods that have already been processed. Now Newbase and Twinfield are the same, and the reconciliation of sales invoices can also continue.

18.3 Accounts payable / purchase invoices position

The old administration contains 100 purchase invoices (outstanding invoices, as well as paid invoices from financially outstanding customer projects). The following question applies here. Do you work with work in progress? If so, you must enter all purchase invoices for projects in progress (financially outstanding). You can perform the following options:

- You work with “accrued creditors. Enter these purchase invoices within Newbase, with the line description “conversion” and the total amount. Check each purchase invoice with “status transferred”, as well as “fin. monitoring manually”, and determine within the payment tab what amount has already been paid.

- Status transferred if checked means that this invoice is no longer transferred to Twinfield, but is considered to have been transferred (after all, this purchase invoice is included as a total amount via the opening balance sheet "accrued creditors".

- Financial monitoring manually means that this purchase invoice is left outside Newbase's control regarding whether or not it has been paid, as this invoice is not listed as a document as an invoice, but as part of the item "accrued creditors".

- Payment tab, indicate whether an invoice has been paid (in part) by means of an order line.

- You do not work with the item “accrued creditors”. Therefore, enter these purchase invoices within Newbase (enable manual numbering) and post them. Naturally, the periods to which the purchase invoices relate must be open. The VAT is also recorded. Book this VAT against periods that have already been processed. Now Newbase and Twinfield are the same, and the reconciliation of purchase invoices can also continue.

The first point of attention is that products / services received in the meantime, which have been booked via an opening balance on "invoices yet to be received", are still reversed within the purchase invoice on the purchase invoice line on "invoices yet to be received". If

Point two is that you want all project costs of ongoing projects to be included in the work in progress. This means that you still want to see all current purchase orders, as well as all closed purchase orders, which are linked to current projects, booked, and that you also want the receipt including finalized purchase invoice booked there. You must determine these ongoing matters yourself.

18.4 Inventory

Within Newbase, all products are loaded, as well as all stock positions filled using a “stock change” record. This means that the stock position has been booked within Newbase and can be omitted from the opening balance sheet. Suppose you have posted an opening balance of inventory, then the journal entries created must be deleted.

18.5 Current purchase orders

You can enter all purchase orders that still need to be (partly) received, as well as all purchase orders for financially open projects, in Newbase. The booking structure within Newbase only posts a “yet to be received” invoice position upon receipt. This means that an “yet to receive” invoices position can be entered within the opening balance sheet. The open purchase orders are received and can be completed.

18.6 Current assembly orders / sales orders

All outstanding sales orders / assembly orders that still need to be (partly) issued must be entered in Newbase. The correct bookings will then be generated when goods are issued. These sales orders can then also be invoiced.

18.7 Time lines

You can enter time on ongoing projects as time lines. The advantage here is that you can also check the total written time on ongoing projects. If there are too many time lines, you can consider booking this as a total amount on the work in progress costs project via the costs program. Then you only have to create one cost line per customer project.