Table of Contents

How does currency work within Newbase

Updated

by MJA

Updated

by MJA

1. General

Within Newbase you have the option to use different currencies.

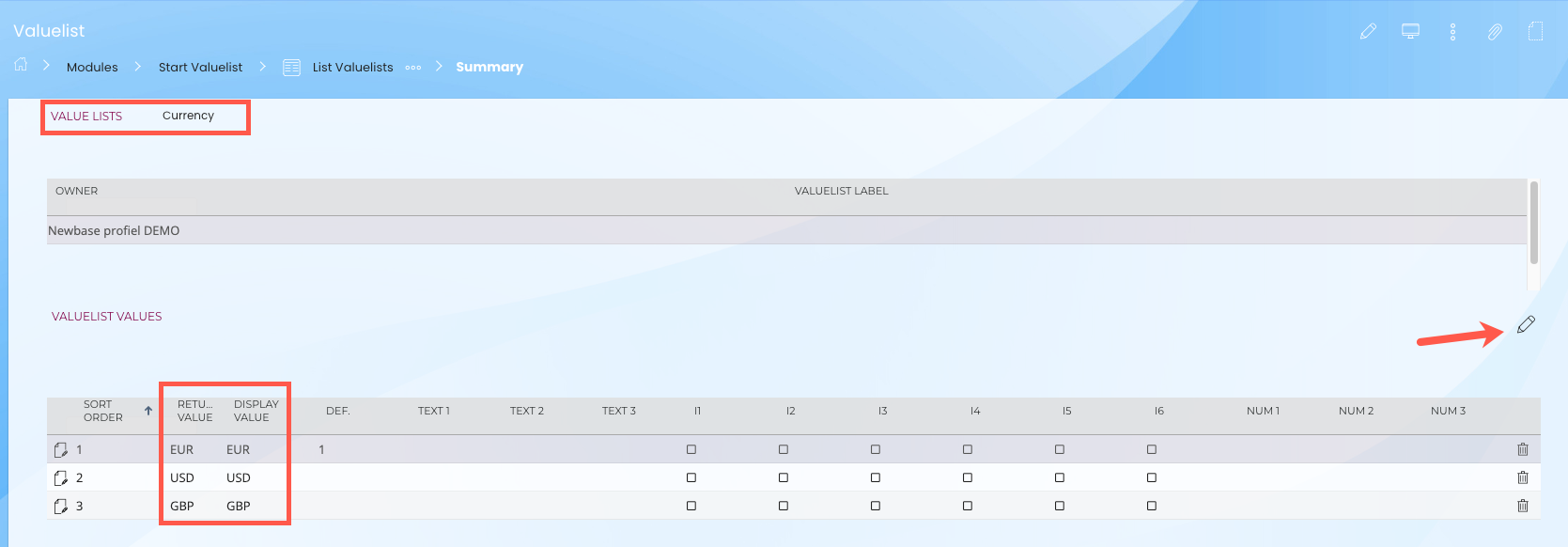

2. Create currency for selection list

You can create different currencies that you can choose from within the module valuelist > currency.

To set up valuelists, you can contact your internal Newbase application manager. Click here for more information about valuelists.

In the return value field AND in the display value field, enter the abbreviation of the currency.

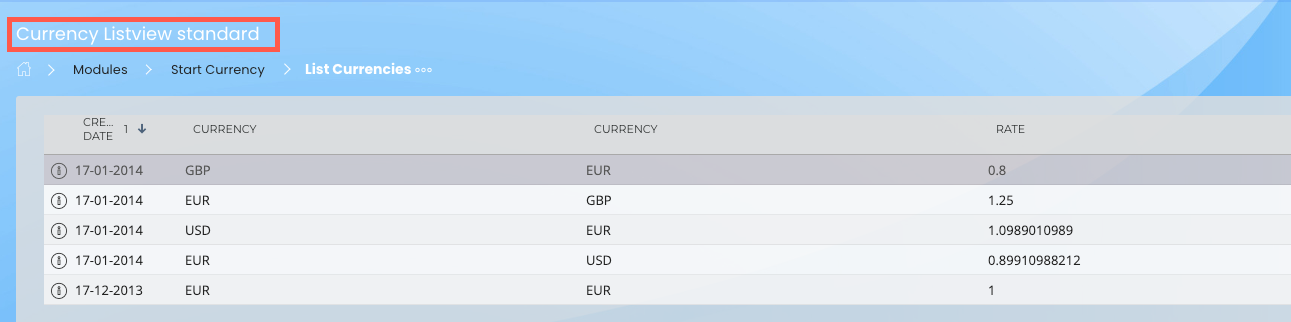

3. Enter currency and the rate in the Currency module

When creating currencies in Newbase, you must always ensure that 4 rates are entered per currency type. Example for GBP:

GBP - EUR

EUR - GBP

GBP - GBP

EUR - EUR

It is therefore necessary that in addition to GBP/EUR and EUR/GBP, you also create EUR/EUR and GBP/GBP.

4. When is the rate retrieved from the settings?

Within Newbase, the rate is retrieved from the above settings for all new documents to be created. If you change a rate, it will not be implemented within existing documents.

5. Can the currency be changed in a document?

It is possible to adjust the rate within a document. So, for example, there may be sales invoices within Newbase, where one document has a different rate compared to another document.

6. Currency when copying document

Prices are always inherited from a previous document. So suppose you create a new sales order, and the rate is 1.39, and you duplicate this document to a sales invoice, then 1.39 is also used as a proposal within the sales invoice (and you can change this again if you wish).

It is not possible to record historical or future prices. Rates therefore apply from the moment they are entered for new financial documents that are created. Existing documents maintain the course at the time the document was created.

After changing the rates, you can immediately use the adjusted rates. Other users will need to restart Newbase.

7. How does currency work in combination with the Twinfield?

How currency works within Newbase in combination with Twinfield depends on the accounting connection you have. Within Newbase you can choose a simple link (purchase and sales ledger) or an extensive accounting link (journal entries). This choice was determined when designing Newbase.

7.1 Simple link to Twinfield & purchase & sales invoices

Suppose you use the simple Twinfield connection, then a sales/purchase invoice with the rate applicable to that document is transferred to Twinfield. For example, Newbase then forwards a USD invoice to Twinfield. This invoice is reconciled within Twinfield and fed back to Newbase as having been paid. This goes into the course of the document. So regardless of the rate setting within Newbase and Twinfield, an invoice of 100 USD is also read as paid 100 USD. No differences arise.

However, within Twinfield, a turnover of EUR 80 can be registered on the debtor within the reporting currency and within Newbase, turnover on the debtor can be EUR 78. This depends on the reporting currency (EUR) and the exchange rate settings in effect at that time, and theoretically differences may arise. There is no accounting problem as the annual accounts are based on Twinfield, and Twinfield is valid as an accounting package for the company. In that case, Newbase only provides turnover information. No general journal entries apply to the simple link, so differences cannot arise within journal entries.

7.2 Extensive Twinfield link (journal entries)

If you use the extensive Twinfield connection, journal entries will be transferred to Twinfield. The sales & purchasing book is always posted at the rate of the document. However, all other entries (for example receipts and issues) are converted at the rate entered/inherited within the financial document and converted to the company currency.

This is where possible differences may arise.

Below are the journal entries in an example based on EUR and USD (100 USD = 90 EUR).

We place a purchase order for a customer project: and the rates between NB and TW are the same:

-100 pieces (VVP 10 EUR) each piece 10 USD total 1,000 USD.

-rate 0.9 within Newbase USD-EUR

-rate 0.9 within Twinfield USD-EUR

reporting currency within Newbase & Twinfield is EURO.

The goods are received, the following journal entry is created:

-WIP project 900 EUR

-ON invoices still to be received EUR 900

The purchase invoice arrives and is processed on goods receipt lines, the following journal entry is created:

-Invoices still to be received 1,000 USD

-TO 1,000 USD

Within Twinfield, the 'invoices yet to be received' position cancel each other out in the reporting currency.

Invoices still to be received

Debit 1,000 USD = 900 EUR

Credit 900 EUR = 900 EUR

Balance = 0.00.

We place a purchase order for a customer project and the rates between NB and TW are NOT the same:

-100 pieces (VVP 10 EUR) each piece 10 USD total 1,000 USD.

-rate 0.90 within Newbase

-rate 0.95 within Twinfield

reporting currency within Newbase & Twinfield is EURO.

The goods are received. The system will make the booking based on the Newbase-Twinfield reporting currency, in this case EUR, and therefore perform a conversion from USD to EUR.

-WIP project 900 EUR

-ON invoices still to be received EUR 900

The purchase invoice arrives and is processed on goods receipt lines, the following journal entry is created:

-Invoices still to be received 1,000 USD

-TO 1,000 USD

Within Twinfield, a difference arises in the position of invoices yet to be received.

Invoices still to be received

Debit 1,000 USD = 950 EUR

Credit 900 EUR = 900 EUR

Balance = 50.00.

Collect payments

The invoice is paid. Newbase collects payments based on USD (currency document). No differences arise here. A purchase-sales invoice is paid in USD, and compared with Newbase in USD. This increases neatly, regardless of the course.

Journal entries

All journal entries that are posted in the general journal are in the reporting currency. Differences never arise here.

Sales book

The sales ledger is denominated in the currency of the document.

So all sales invoices from customer A:

-invoice 1 total 100,000 USD rate Newbase is 0.90 so 90,000 EUR rate Twinfield 0.88 so 88,000 EUR

-invoice 2 total 100,000 USD Newbase rate is 0.92 so EUR 92,000 Twinfield rate 0.91 so EUR 91,000

-invoice 3 total 100,000 USD Newbase rate is 0.95 so EUR 95,000 Twinfield rate 0.95 so EUR 95,000

deliver correct bookings to Twinfield, but the display may be different in Twinfield than in Newbase. We leave this this way as our customers would like to play “commercially” with a rate, but the financial administration would like to determine for itself which rate is used within Twinfield (since this of course determines the period/annual result).

Purchasing book

The purchase journal is denominated in the currency of the document.

So all purchase invoices from supplier A:

-invoice 1 total 100,000 USD rate Newbase 0.90 so 90,000 EUR rate Twinfield 0.88 88,000 EUR

-invoice 2 total 100,000 USD rate Newbase 0.92 so 92,000 EUR rate Twinfield 0.91 91,000 EUR

-invoice 3 total 100,000 USD rate Newbase 0.95 so 95,000 EUR rate Twinfield 0.95 95,000 EUR

deliver correct bookings to Twinfield, but the display may be different in Twinfield than in Newbase. We leave this as our customers would like to play “commercially” with a rate, but the financial administration does not want this and to be “boss” over the administrative rate (since this of course determines the period/annual result).

Differences based on receipts and purchase invoices

As indicated in 1.2.1, a difference may arise in the position of invoices still to be received. You can determine this by comparing the “invoices yet to be received” position within Newbase as a total amount at the end of a period / year with the “invoices yet to be received” position within Twinfield. You should record a possible difference in your result under currency differences within Twinfield. If you still want to book this on a customer project, you can still book this per project by means of a “cost booking”, whereby the contra account in this example will be “currency differences”.

Different currencies per debtor

Alternate invoicing in different currencies is possible, but has a few snags.

First, only one currency can be set per debtor, and that currency will be used by default for all documents created for that debtor.

However: You can have the currency differ per document in the settings tab. If you change this, the rate will also change and, if there are rules, you will also be asked whether you want prices to be converted. The default currency is the currency set for the debtor, but you can adjust this per document.

If you adjust the currency on the sales order, that setting will be taken into account when duplicating the document.

Secondly, you can think of product prices. In the product, price scale tab, you can enter multiple price scales and you must indicate a currency for each price scale.

If you want to link products in a document that is set in USD, you must ensure that you have also entered product prices in USD in the price scale, otherwise no sales price will appear in the line.